Payroll

Payroll is a powerful, cost-effective solution that will save you time and money in managing your payroll.

Checkmark Payroll is the simplest way to automate the tedious activities involved in managing payroll. Whether you are doing payroll for your own business or offering a payroll service, Payroll is a powerful, cost-effective solution that will save you time and money. Payroll runs unlimited companies and unlimited employees at the same low price.

Benefits/Features

Save Time and Get More Accomplished.

Save Time and Get More Accomplished.

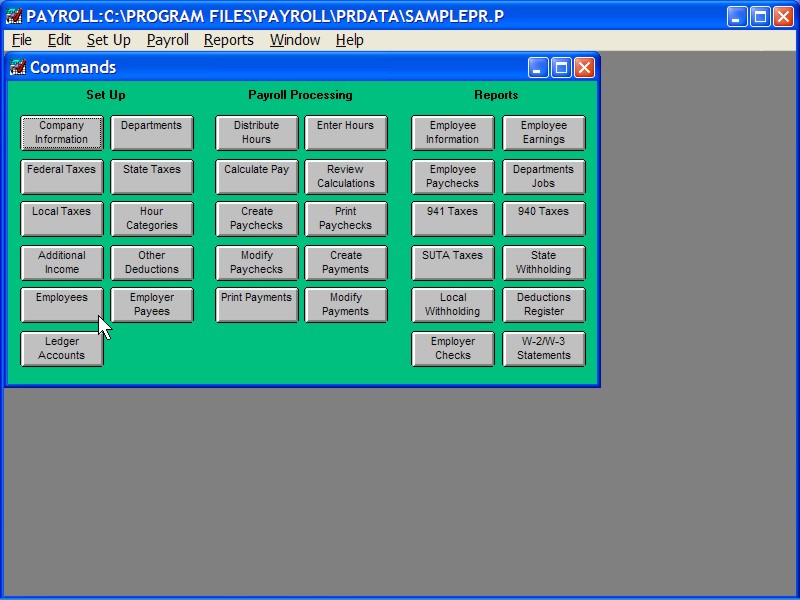

Payroll automates a variety of payroll-oriented tasks such as:

- Set up new employees quickly using the Employee Template. Start any time of year!

- Easily import employee hour data from a spreadsheet, time clock software or ASCII files. Or, use the simple spreadsheet entry form.

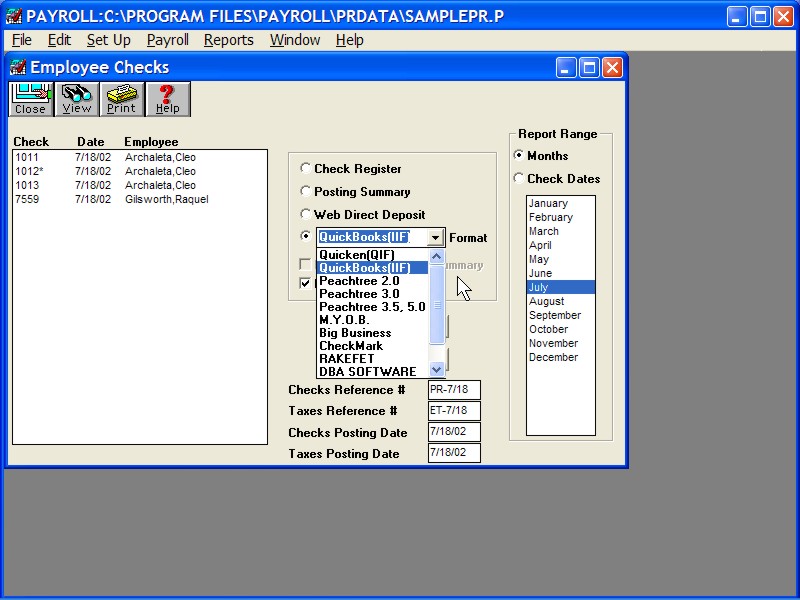

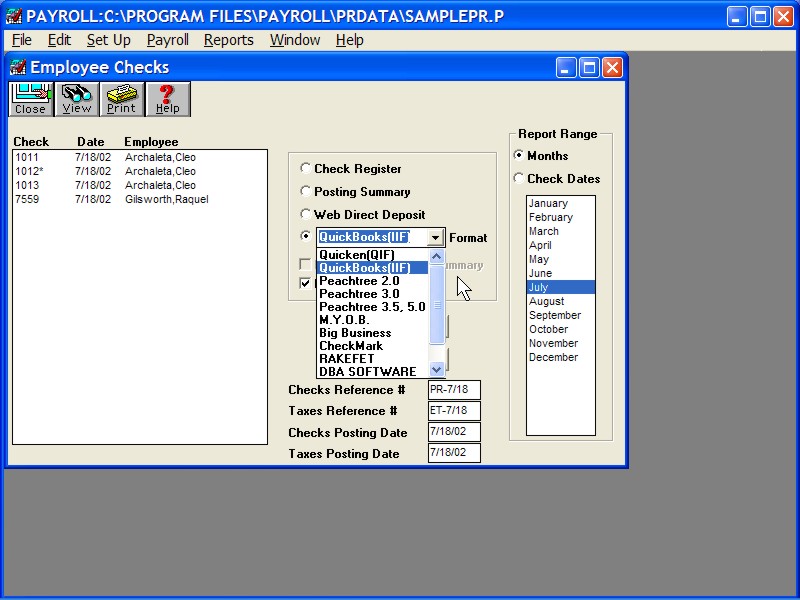

- Quickly export and post data to QuickBooks, Peachtree and most accounting programs.

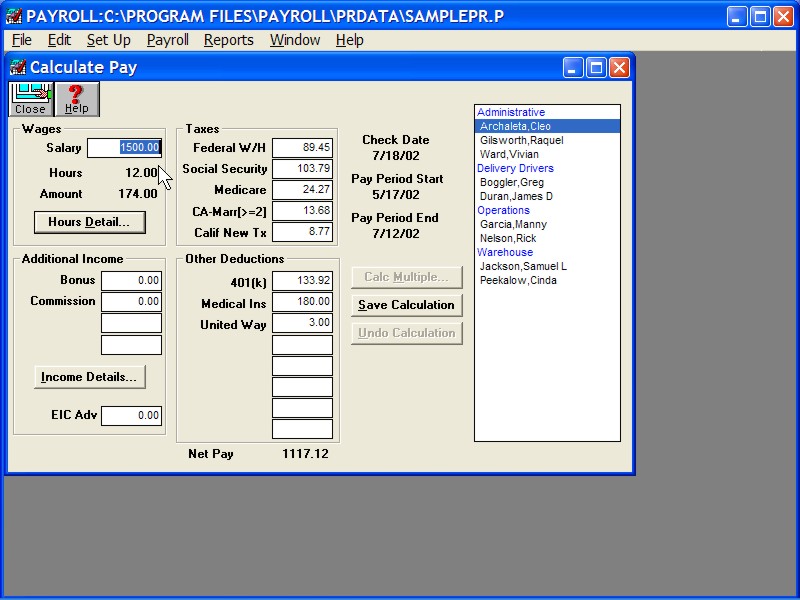

- Automatically calculate local, state and federal taxes.

- Automatically calculate sick leave and vacation accruals.

- Print check stubs including current and year-to-date totals.

- Optional service for web-based direct deposit of paychecks

- Use federal MMREF-1 format for electronic filing of W-2s and W-3s to the SSA and selected states.

Wide Variety of Advanced, Customizable Features.

Wide Variety of Advanced, Customizable Features.

- Start using Payroll at any time of the year—just enter year-to-date balances, and you are ready to go.

- Great for payroll services or in-house payroll. Do payroll for an unlimited number of employees at an unlimited number of companies for the same low price.

- Define 20 customizable incomes and 30 customizable deductions.

- Define up to 4 hourly rates for each employee plus overtime and double time.

- Setup exempt employees and withhold additional taxes if needed.

- Accurately calculate tax-sheltered deductions like 401Ks.

- Handle payroll "after the fact."

- Calculate employer matching and print checks for related to the matching amounts.

- Override deductions, incomes or taxes

- Handle multiple checks per employee per pay period as well as third party checks.

- Works with nearly any kind of pre-printed paper check format or use web-based direct deposit (optional service). Optional MICR module lets you print MICR encoding directly on blank checks (see below).

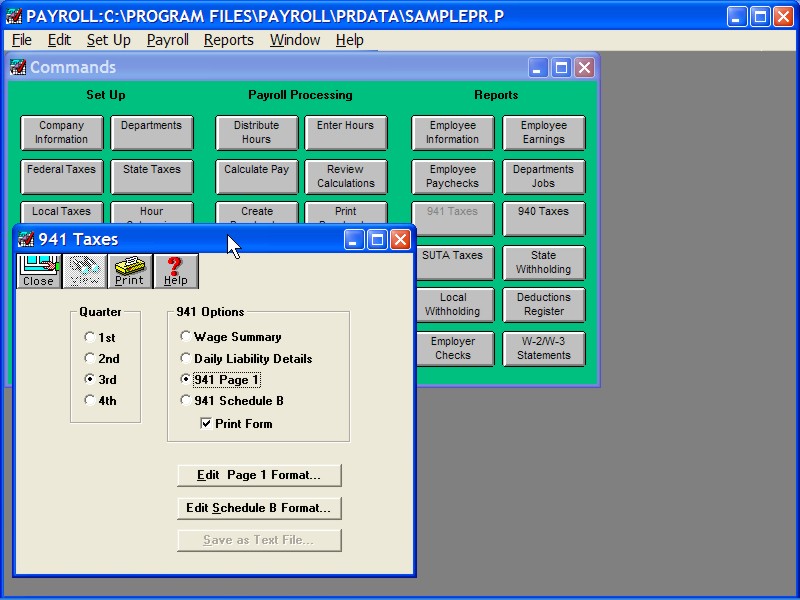

Comprehensive Reporting.

Comprehensive Reporting.

- Summarized state and local withholding and SUTA tax information

- Prints Federal W-2 and W-3 forms (and can create file for electronic filing).

- Prints federal Form 941

- Prints employer matching amounts for state reporting

- Summarized 940 information

- Employee Information

- Prints State SUTA and Wage Summary data

- Prints California DE-6 form and generates the DE-6 MMREF form for electronic filing

- Summarizes California SDI, state withholding and SUTA

- Report on payroll data rolled up by department

Up-to-date Data Ensures your Payroll Taxes are Always Accurate.

- Payroll comes pre-loaded with the current year’s federal and state tax tables (if you purchase in Oct-Dec, the following year’s tax tables are free as well).

- Annual tax table updates (optional) can be purchased (current cost is $125 annually).

- Tax rates are monitored year round. If any changes occur mid-year, patches will be available for immediate downloading.

- Tax tables can also be modified and maintained manually at no cost.

Reviews/Testimonials

CPA Technology Advisor, 4 stars (out of 5): "It has all of the essential functionality to process a variety of payroll situations without overkill on features and functions. . .The pricing is very attractive at $249 for an unlimited number of users and companies. . .CheckMark Payroll seems like a great solution for accountants who want to offer a boutique-level payroll service. It is simple, yet comprehensive enough to handle most payroll situations."

Accounting Today: "CheckMark has elegantly crystallized and executed the concept of ease of use. . ."

Carolyn O., Franklin, TN: "I've been in accounting for over 20 years and have yet to find any payroll package as easy to use."

System Requirements

10 MB Disk space. For Windows: Windows 2000 or higher, including XP and Vista. For Mac: a Power PC running OS 8.6 or higher is required. It is native to Mac OS X.

No risk! Payroll comes with a 60-day money back guarantee!

Optional MICR Encoding Module for Payroll New!

With the optional MICR encoding module, you can print the MICR bank routing numbers and bank account information on blank Check Stock. This saves time and improves customer service for multi-company payroll services, since you won't need to keep a stock of pre-printed/MICR encoded blank checks from each of your customers.

Payroll Demo CD

The free Payroll Demo CD lets you try out the intuitive interface before purchasing (PC Version only).